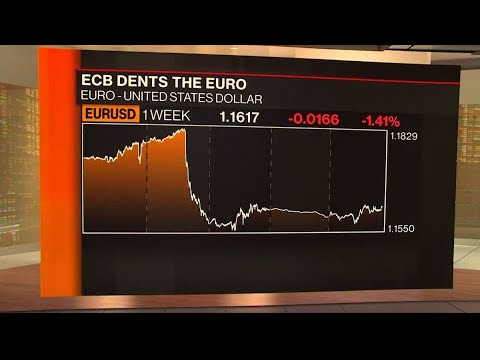

The first offers you 7.24% compounded quarterly while the second offers you a lower rate of 7.18% but compounds interest weekly. Without considering any other fees at this time, which is the better terms? Using the effective annual rate calculator you can find the following. With this effective annual yield calculator, you can easily calculate the real return on your bond investment. This metric can help you to calculate your return based on coupon payments after reinvesting them.

These are typically corporations, cities, and the United States government. An initial amount, or the principal, is paid back to the bondholder at the end of the issue period. Before the payback date, there are set periods when interest is paid to the investor. The stated annual interest rate and the effective interest rate can be significantly different, due to compounding. The effective interest rate is important in figuring out the best loan or determining which investment offers the highest rate of return. As Bond A pays coupons semi-annually, its coupon frequency is 2, and this is a number you need to put in the effective annual yield formula in the next step.

Gordon Scott has been an active investor and technical analyst or 20+ years.

Understanding Effective Yield

To compound my problems, I basically did not have a preparation strategy. Having no background in finance at all, I tried very hard to read the curriculum from cover to cover, but eventually that fell flat. I can still recall the number of times I dozed off while studying, or just going back and forth trying to understand even the simplest concept. Now that you understand what effective annual yield formula the effective annual yield is and how to use the effective annual yield equation, let’s talk about why it is crucial to understand this concept. The last step is to calculate the effective annual yield using the effective annual yield equation. When banks are paying interest on your deposit account, the EAR is advertised to look more attractive than the stated interest rate.

Hypothetical illustrations may provide historical or current performance information. We realise some candidates prefer to purchase courses as they need individually, so we endeavour to give more options to our potential students. Check out our Udemy Courses Page to find out which of our courses are available on Udemy for your purchase. For those of you who are new to Udemy, it is the world’s largest marketplace for online courses.

What is the effective annual yield on my investment?

The yield-to-maturity (YTM) is the rate of return earned on a bond that is held until maturity. To compare the effective yield to the yield-to-maturity (YTM), convert the YTM to an effective annual yield. If the YTM is greater than the bond’s effective yield, then the bond is trading at a discount to par. On the other hand, if the YTM is less than the effective yield, the bond is selling at a premium.

- The effective yield will be the absolute increase as a percentage of the principal invested.

- We also need to know the time duration of the holding period return, which is 211 (i.e. the number of days between 1 January 2017 and 31 July 2017).

- It is the last payment a bond investor will receive if the bond is held to maturity.

- The effective annual yield definition is the annual return an investor can get from their coupon payments on a bond after considering the effect of reinvesting the coupon payments.

- Are you a CFA Level I candidate, or someone who is exploring taking the CFA exam?

The investors will get the returns by receiving coupons throughout the life of the bond as well as the face value of the bond when it matures. Since the launch on 1 March, we have had more than 250 paid enrolments. While we are heartened by this figure, nothing beats knowing that our course has reached 50 countries around the world! This certainly spurs us on to produce more materials to ease the burden of CFA candidates worldwide. What’s more, these quick references are deeply integrated in our lessons, so you get a good idea of what the lesson covers even before watching the video.

Effective Yield vs. Yield-to-Maturity (YTM)

Effective yield is one way that bondholders can measure their yields on bonds. There’s also the current yield, which represents a bond’s annual return based on its annual coupon payments and current price, as opposed to the face value. First Federal is offering an annual interest rate of 7.20%, while Second National Bank is offering a rate of 7.00% with daily compounding. To make a fair comparison, the Second National Bank needs to be converted into an effective yield. When banks are charging interest, the stated interest rate is used instead of the effective annual interest rate. This is done to make consumers believe that they are paying a lower interest rate.

APR vs. APY: What’s the Difference? – Banking – Investopedia

APR vs. APY: What’s the Difference? – Banking.

Posted: Mon, 13 Nov 2017 21:31:02 GMT [source]

Simply put, the effective annual interest rate is the rate of interest that an investor can earn (or pay) in a year after taking into consideration compounding. Coupon frequency is the number of coupon payments you will receive from a bond in a year. For example, a semi-annual coupon frequency means that you will receive two coupon payments in a year. This article will help you understand what the effective annual yield is and how to calculate it using the effective annual yield formula. We will also demonstrate some calculation examples to help you understand the concept. This rate can then be multiplied by the principal amount of the bond to find how much can be earned from a bond.

Effective Annual Rate Formula

One method of expressing yield (annualised), assuming compound interest. It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties. The calculations provided should not be construed as financial, legal or tax advice. In addition, such information should not be relied upon as the only source of information. This information is supplied from sources we believe to be reliable but we cannot guarantee its accuracy.

- Consider an investment of $100 at a nominal rate of 10% compounded monthly.

- The effective annual yield can be determined to see the more accurate interest rate received when dividends are reinvested.

- To compound my problems, I basically did not have a preparation strategy.

The reason the effective yield is slightly different is that although many are given in terms of yearly return, the actual compound in shorter intervals such as months. This leads to a slight increase in the actual return over a year period. An effective annual yield is a measure of the true return on an investment over a time period. For a short-term investment with very good liquidity, yet with higher returns than money markets, you can invest in short-term bonds.

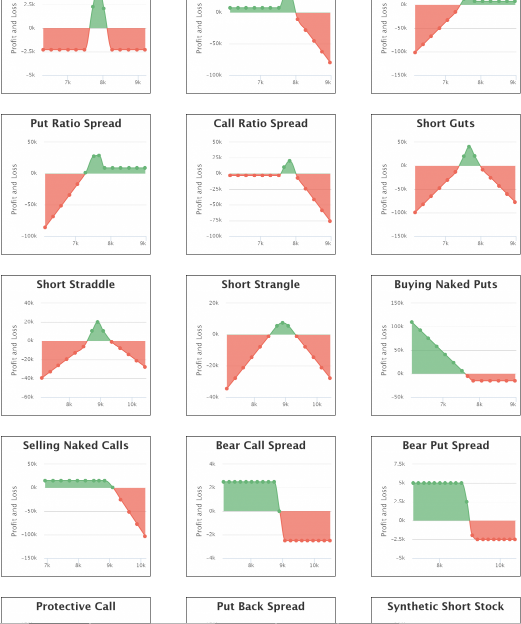

When compounding is applied, the effective rate of interest paid will always be higher than the nominal rate applied. Effective yield is useful when you are considering various investment options where the interest rates are expressed at different compounding rates. In such a situation, you can convert all the rates into effective annual yields and then make an informed decision. The difference between the two is that the nominal rate does not take compounding into consideration, while the effective annual yield does. The Effective Annual Interest Rate (EAR) is the interest rate that is adjusted for compounding over a given period.

An effective annual yield is defined as the total profit or returns on a bond that an investor receives. An effective annual yield differs from nominal yield or coupon rate on a bond. For example, an investor purchased a $1000 bond, with 5% interest per year with a semi-annual payment. The effective annual yield ends up being more than the nominal yield, and it is a more accurate indicator of how much is actually earned from the bond.

We have an irresistible offer for you to upgrade to our Level I Premium Membership, where you will gain full access to ALL 10 topical courses under the CFA Level I curriculum. This refund processing fee is to compensate us for the payment processing fee that we paid when you made the purchase. Take your learning and productivity to the next level with our Premium Templates. Over the course of 10 years, reinvesting the dividends gives a total of $7573.

Annual Percentage Rate (APR): What It Means and How It Works – Investopedia

Annual Percentage Rate (APR): What It Means and How It Works.

Posted: Tue, 28 Mar 2017 11:58:16 GMT [source]

In the case of compounding, the EAR is always higher than the stated annual interest rate. Note that since the bond pays interest semi-annually, payments will be made twice to the bondholder per year; hence, the number of payments per year is two. Though similar, current yield doesn’t assume coupon reinvestment, as effective yield does. We also need to know the time duration of the holding period return, which is 211 (i.e. the number of days between 1 January 2017 and 31 July 2017). Taking advantage of compound interest need not be a passive strategy on your part.